In the past two years during world pandemic of Covid, pharmaceutical and healthcare companies saw massive profits and with it also the growth of their stocks. Since the Covid situation around the globe is calming down, or at least it seems like it is, we decided to investigate few companies in healthcare sector, to see how they are performing and what are their forecasts for the future, if Covid will be eliminated for good.

What kind of companies are in Healthcare sector?

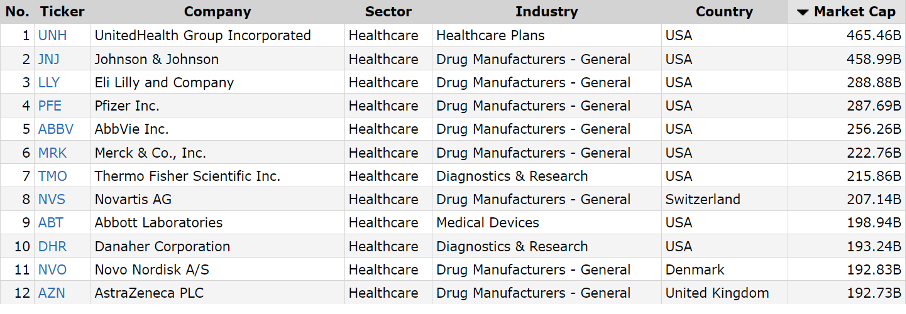

According to Finviz, healthcare sector can be divided into drug manufacturers, healthcare plans, medical devices, diagnostics and research, medical institutions and biotech. Because there are many companies in this sector, we will focus more on the biggest companies according to market capitalization. In healthcare plans, and in healthcare sector in general, UnitedHealth Group Inc is the biggest company, with market capitalization of 465.46 billion USD. On second place, we can find drug manufacturer Johnson and Johnson with market cap of 458.99 billion USD. First seven places are taken by US companies, only on 8th place we can find Novartis, a European company with HQ in Switzerland, and has market capitalization of 207.14 billion USD. [1]

Top 12 healthcare companies by market capitalization. (Source: Finviz)

UnitedHealth Group Inc

We will start with the biggest company in healthcare sector. They are responsible for health care coverage, software and data consultancy services. The Group consists of multiple companies, which are UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx.[2] Each one of them is expert in some different field and that way they can cover more. Maybe that is the reason, why they are the most successful.

Revenue of UnitedHealth Group in first quarter of 2022 were 80.1 billion USD, which is growth of 10 billion USD or 14% Year-Over-Year. Earnings form operations were 7 billion USD, while cash flow was 5.3 billion USD. And the most important data for investors, company reported earnings of 5.27 USD per share and adjusted earnings were 5.49 USD per share.[3]

Movement of UnitedHealth Group stock in last five years. (Source: Trading Economics) *

As it can be seen from the chart, the price of stocks is constantly on the rise for the last five years, with some small corrections. The price of a stock at the time of writing is on 489.43 USD. Analysts’ opinions from Tipranks are: 15 says buy, 4 say hold, and no one said sell the stock. Target prices are also very optimistic, with the highest target price on 665 USD, and average target price on 588 USD, which means that according to them, there is still a lot of potential for a stock to grow. [1],[4]

Johnson & Johnson

We continue with the second biggest company in healthcare sector by market capitalization, Johnson & Johnson. The most of you have probably heard of the company in the last two years, as they are one of the leading companies that produced the Covid vaccine. Despite some speculations and bad name, that their vaccine is suspected to cause blood clogs, the company is still standing strong, which also data and reports confirm.

Company slightly missed the predictions of Wall Street when announcing the first quarter financial reports. The reported revenue was 23.4 billion USD, and the expected was 23.6 billion USD. Company also reported earnings of 2.67 USD per share, when the expected was 2.58 USD. Despite the company selling Covid vaccines globally worth of 457 million USD, the final net income of the company was 5.15 billion USD, which is a 17% decrease when compared to the first quarter of 2021. [5]

Even though Covid seems like coming to an end, company has many other sectors they are working in, so we can say that they have some kind of a plan B.

Movement of Johnson & Johnson stock in last five years. (Source: Trading Economics) *

Johnson & Johnson’s stocks, same as UnitedHealth Group’s stocks, are in uprising trend with some corrections from time to time. At the time of writing, the price of a stock is on 173.71 USD. 10 analysts at Tipranks are dividing their opinion about the company as: 6 of them are saying to buy the stock, while 4 are saying to hold it and no one said sell. Also target prices are set rather positive, with the highest target price set to 215 USD, and an average target price set to 193.70 USD. [2],[6]

Conclusion

It seems that both companies have nicely divided sectors of their companies, so they can cover more fields and with that lower the risk of losing profit. While UnitedHealth Group stands strong and has good forecasts for the future, Johnson & Johnson shows some decline by the Covid situation. However, as mentioned, they are covering more sectors so the company should be just fine.

Healthcare sector is one of the strongest sectors, so do not wait and make a move in healthcare investments! [3]

--------

* Past performance is no guarantee of future results.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

[1] https://finviz.com/screener.ashx?v=111&f=sec_healthcare&o=-marketcap

[2] https://www.forbes.com/companies/unitedhealth-group/?sh=56fbdc667cb0